Research is central to what we do

At Weighhouse, our research is 100% indendent. Our research is mostly bespoke, tailored to individual clients. But we do publish some of our insights here, particularly after trips, or on key themes of interest.

At Weighhouse, our research is 100% indendent. Our research is mostly bespoke, tailored to individual clients. But we do publish some of our insights here, particularly after trips, or on key themes of interest.

The Warsaw Stock Exchange re-opened in 1991. Mass privatisation made transparency essential. The solution? Monthly reporting for listed companies. As the US considers dropping the requirement for quarterly reporting, we look at the pros and cons.

Bankers who were paying attention as graduates will remember the bond market dance: one arm up, the other down, illustrating “yields up, prices down.” In Emerging Markets, the shorthand is: “dollar up, EM equities underperform.” We take a look at the relationship.

Does growth drive equity returns in emerging markets? We examine equity market returns over the past two decades and find that growth might matter – at least, more than sceptics often claim.

They say you’re only truly qualified as an emerging markets investor once you’ve been stopped by local police, told your papers aren’t in order, and detained — despite everything being perfectly fine. We examine which emerging markets are winning – and losing – the battle against corruption.

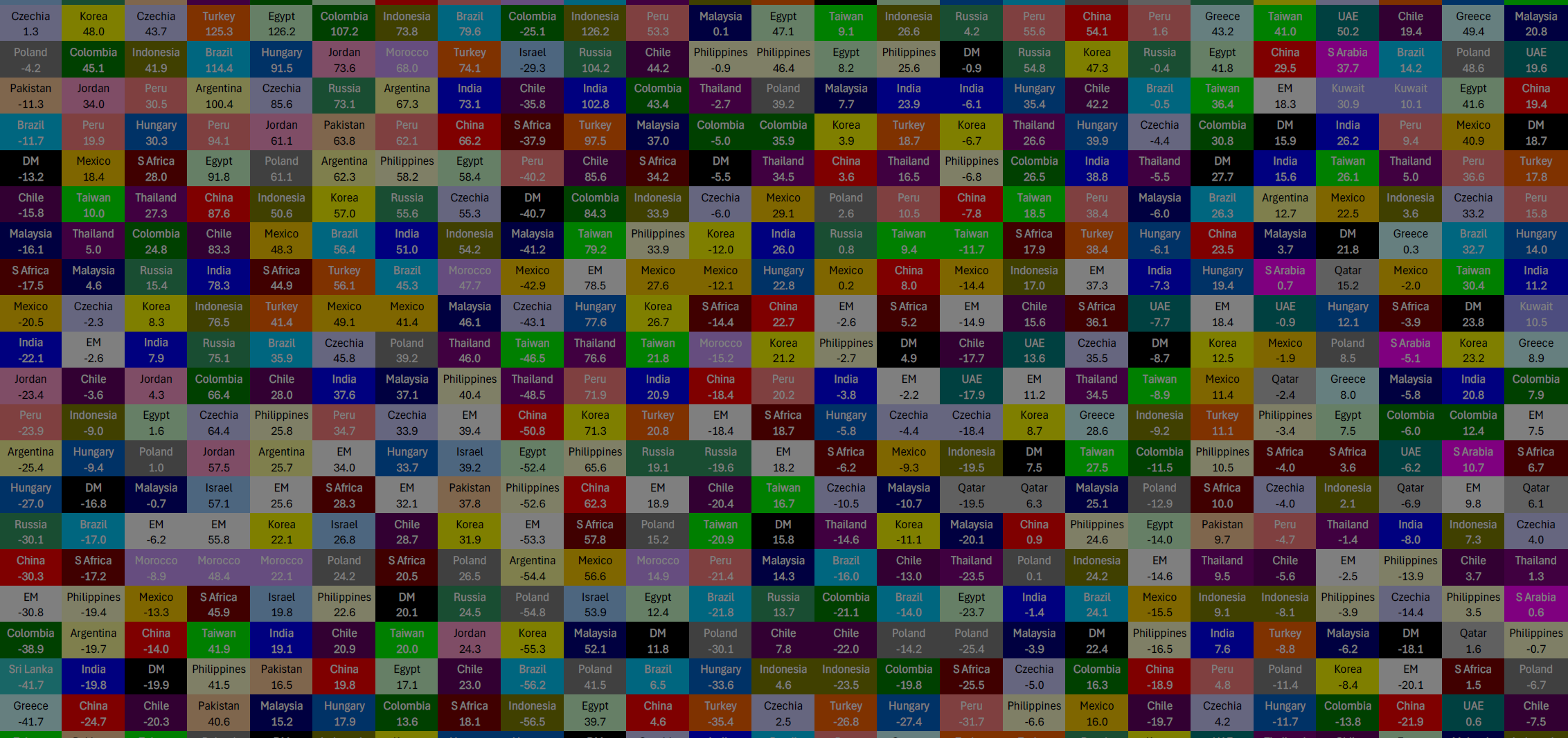

To celebrate making it through a quarter of this century, here’s a technicolor look at 25 years of ranked Emerging Market equity returns.

Too busy to have babies? Most of MSCI EM is past peak working age population. But still, India’s working-age population growth will more than offset China’s decline until 2033.

Guatemala is a 3.5% growth story without significant imbalances (assuming remittances continue). It should be growing faster, but for growth to break out on the upside, a significant step up in infrastructure and investment will be needed, funded by improved government tax collection with stronger institutions to support investment and FDI.